Understanding the Appeal of Limited Edition Sneakers

Why Sneaker Lovers Obsess Over the Rare and Unrepeatable

Picture this: a sleek pair of sneakers dropping with only 500 pairs available worldwide. The hunt begins, hearts race, and people line up overnight or crash online stores in seconds. What is it that drives such frenzy? It’s not just footwear—it’s a badge of belonging, a piece of culture wrapped in high-end design.

Limited edition sneakers often hold the magic of scarcity, but their appeal goes deeper than numbers. They’re storytellers. Think about the Off-White x Nike collaborations, where every swoosh and zip tie screams innovation. Or the legendary Air Jordan 1 Retro “Bred”, channeling 1985 basketball glory. These shoes don’t just sit on shelves—they carry history, rebellion, and even luxury status on their soles.

- Exclusivity: Owning what few others can ever get adds to their allure.

- Artistry: Collaborations with artists and designers turn sneakers into wearable art.

And let’s not dismiss the hype machine. From Instagram reels to sneakerhead forums, the buzz builds a community where these shoes aren’t just fashion—they’re stakes in a lifestyle.

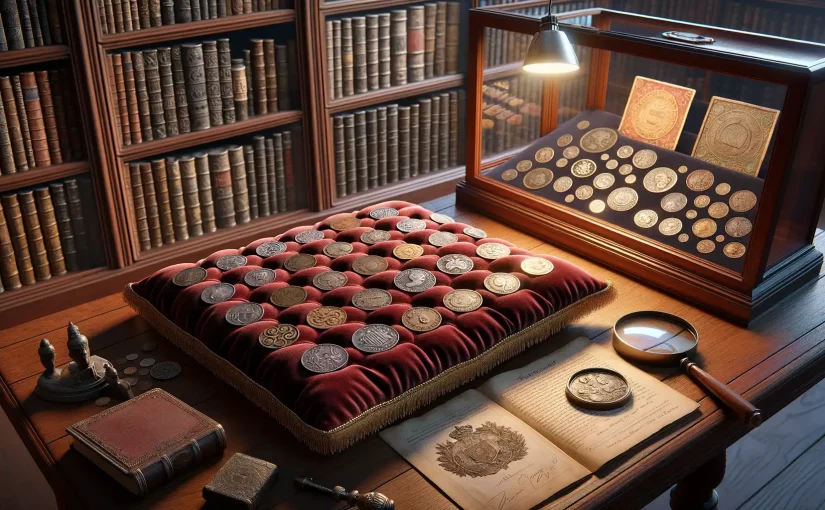

The Historical and Financial Value of Rare Coins

Why Rare Coins Are Treasures From the Past

Imagine holding a piece of history in the palm of your hand—a coin minted centuries ago, bearing the mark of an ancient ruler or a pivotal moment in time. Unlike modern investments, rare coins carry stories that resonate deeply. Each scratch or detail tells a tale: the bustling markets they passed through, the wars they survived, or the monarchs who decreed their creation. They’re not just currency; they’re windows into bygone eras.

Collecting rare coins allows you to own tangible pieces of history. For instance, a 1909-S VDB Lincoln Penny isn’t just worth thousands of dollars—it’s a symbol of historical scarcity and artistic craftsmanship. And then there are gold and silver coins, which hold intrinsic metal value on top of their rarity.

- Roman denarii, minted over 2,000 years ago, can still be bought by modern collectors.

- The 1933 Double Eagle, a U.S. gold coin, sold for $18.9 million at auction in 2021!

This dual appeal—historical significance and financial worth—is why rare coins continue to enchant investors and historians alike.

Building Wealth with Timeless Charm

But rare coins aren’t just narrators of history—they also shine as investment opportunities. Their value is often immune to trends. While sneakers peak and fall based on hype, a well-preserved Draped Bust Dollar steadily appreciates over decades. This stability in value gives coins an edge during uncertain times when markets fluctuate.

The key lies in rarity. Coins like the Flowing Hair Silver Dollar (the first-ever U.S. dollar minted) are inherently limited in supply; what exists now is all humanity will ever have. Add to that the allure of precious metals like gold and silver, and you get a unique blend of liquidity and long-term potential.

Coins don’t just sit in a safe. They create emotional connections, open doors to fascinating communities, and hold the promise of wealth—one glittering edge at a time.

Comparative Investment Potential: Sneakers vs. Coins

What Makes Sneakers and Coins Shine?

Ever compared a pair of limited-edition Air Jordans to a centuries-old Roman denarius? It’s like pitting street culture against ancient history—both dazzling in their own right, yet entirely different beasts when it comes to investment appeal.

With sneakers, you’re tapping into modern-day hype. Think collabs with stars like Travis Scott or brands like Off-White. The resale market is booming, with some pairs skyrocketing in value overnight. A $200 retail drop can morph into a $2,000 goldmine after a single Instagram post.

Coins, on the other hand, are all about timelessness. Collectors treasure pieces like the rare 1794 Flowing Hair Dollar not just for their beauty but for the stories locked inside each mint mark and patina. They’ve weathered centuries, markets, even empires, making them reliable in downturns.

- Liquidity: Sneakers sell fast—apps like StockX make flipping seamless, while coins can take longer to move.

- Values Over Time: Sneakers may burn bright and fade fast; rare coins often appreciate slowly but steadily.

Whether you’re chasing nostalgia or legacy, one thing’s certain: both markets reward passion and savvy in spades.

Risks and Challenges in Both Markets

The Stormy Waters of Sneaker Investments

Picture this: you’ve just snagged a pair of Yeezy Boost 350 “Pirate Black”, thinking you’ll flip them for gold. But wait – trends are fickle, like a stormy sea. Sneakers can be here today, irrelevant tomorrow. One major risk? Market oversaturation. If brands churn out too many “limited editions,” the exclusivity fades quicker than you can say “resale.”

Counterfeiting is another lurking danger. Imagine celebrating your big sale, only to discover you’ve sold (or worse, bought) a high-quality fake. Ouch. Keep in mind: condition is EVERYTHING in sneaker trading. A tiny scuff could lower the value by hundreds.

And don’t overlook storage. Sneakers are physical assets—they crack, yellow, and mold with time. If you’re not careful, your investment might literally fall apart.

- Key risks: counterfeits, rapidly shifting trends, physical degradation

- Solution: third-party authentication services and climate-controlled storage

The Tightrope Walk of Rare Coin Collecting

Now let’s dive into the glittering yet precarious world of rare coins. Sure, a coin like the 1804 Draped Bust Dollar might promise breathtaking returns, but it’s not all rainbows and treasure chests. Coins thrive on historical significance, rarity, and condition—but verifying these factors requires a lot more expertise than Googling. One misidentified mint mark? Your “treasure” becomes a glorified paperweight.

Then there’s liquidity. Unlike sneakers, which have booming online platforms like StockX, selling a coin often means hunting for the right buyer—a process that can drag on for months. And let’s not forget the hefty dealer fees. In some cases, profits melt away like ice under the sun.

Rare coins are also subject to external risks like fluctuating precious metal prices or economic instability, making them feel like a tightrope act: one wrong move, and you’re plunging into financial uncertainty.

Would you confidently wade through these waters? Or does one market seem less slippery to you?

Tips for Diversifying Your Investment Portfolio

Embrace the Art of Balancing Investments

Picture this: your investment portfolio is like a stylish outfit. Would you step out wearing only one color or texture? Of course not! Just like mixing denim with leather creates a fashion-forward statement, blending diverse investments—such as limited-edition sneakers and rare coins—can elevate your financial game.

Start by asking yourself: what speaks to you? Are you inspired by the cultural buzz of streetwear drops? Or perhaps the timeless beauty and history embedded in a 19th-century gold coin sparks your imagination? Your passions can guide where to begin, but don’t stop there—true diversification means stepping outside your comfort zone.

- Mix asset categories: Combine sneakers and coins with stocks, real estate, or even fine art. Think of each as a unique thread woven into the fabric of financial security.

- Stay fluid: Trends evolve. Today it’s Yeezys; tomorrow, vintage New Balance could steal the spotlight. Watch the market and be willing to adjust.

This strategy isn’t about filling slots—it’s about crafting a rich, textured investment tapestry that resonates with who you are.